Enhance Your Structure: Know-how in Trust Foundations

Enhance Your Structure: Know-how in Trust Foundations

Blog Article

Guarding Your Possessions: Trust Fund Foundation Proficiency within your reaches

In today's complicated monetary landscape, making sure the protection and development of your assets is critical. Trust fund structures serve as a cornerstone for securing your riches and tradition, supplying an organized strategy to property defense.

Relevance of Trust Fund Structures

Depend on structures play an important function in establishing trustworthiness and cultivating solid partnerships in various professional setups. Building trust is important for companies to thrive, as it develops the basis of successful cooperations and collaborations. When trust fund is existing, individuals feel extra positive in their interactions, leading to raised performance and effectiveness. Count on foundations act as the keystone for honest decision-making and transparent interaction within organizations. By focusing on depend on, companies can develop a positive job society where employees really feel valued and appreciated.

Advantages of Specialist Advice

Structure on the structure of depend on in expert connections, looking for professional advice offers important benefits for people and companies alike. Professional support offers a wealth of knowledge and experience that can aid browse complicated monetary, legal, or strategic obstacles easily. By leveraging the competence of professionals in different fields, individuals and companies can make enlightened decisions that align with their objectives and desires.

One considerable benefit of specialist support is the capability to access specialized knowledge that might not be readily offered or else. Professionals can offer understandings and point of views that can lead to cutting-edge services and opportunities for development. Additionally, collaborating with professionals can aid alleviate dangers and unpredictabilities by supplying a clear roadmap for success.

Furthermore, specialist assistance can conserve time and resources by simplifying processes and staying clear of expensive blunders. trust foundations. Experts can supply individualized advice customized to specific requirements, ensuring that every decision is educated and tactical. On the whole, the benefits of professional advice are multifaceted, making it a useful asset in securing and making the most of properties for the long term

Ensuring Financial Safety And Security

Guaranteeing monetary safety and security involves a complex strategy that incorporates numerous elements of wealth management. By spreading out financial investments across different property classes, such as stocks, bonds, actual estate, and assets, the danger of significant economic loss can be minimized.

Furthermore, maintaining a reserve is vital to secure against unanticipated costs or income disturbances. Professionals recommend establishing aside three to 6 months' well worth of living expenses in a fluid, quickly obtainable account. This fund functions as a financial safety and security internet, providing comfort during stormy times.

Regularly assessing and changing economic plans in feedback to altering circumstances is likewise paramount. Life occasions, market variations, and legislative adjustments can impact economic stability, emphasizing the importance of continuous evaluation and adaptation in the search of long-term monetary security - trust foundations. By executing these approaches thoughtfully and constantly, people can fortify their monetary ground and job towards a much more safe and secure future

Safeguarding Your Possessions Properly

With a solid foundation in position for economic security with diversity and reserve maintenance, the next vital action is guarding your assets efficiently. Securing properties entails protecting your wealth from prospective dangers such as market volatility, economic slumps, legal actions, and unpredicted expenses. One effective technique is possession allowance, which entails spreading your financial investments internet throughout numerous property courses to lower risk. Expanding your profile can help alleviate losses in one location by stabilizing it with gains in one more.

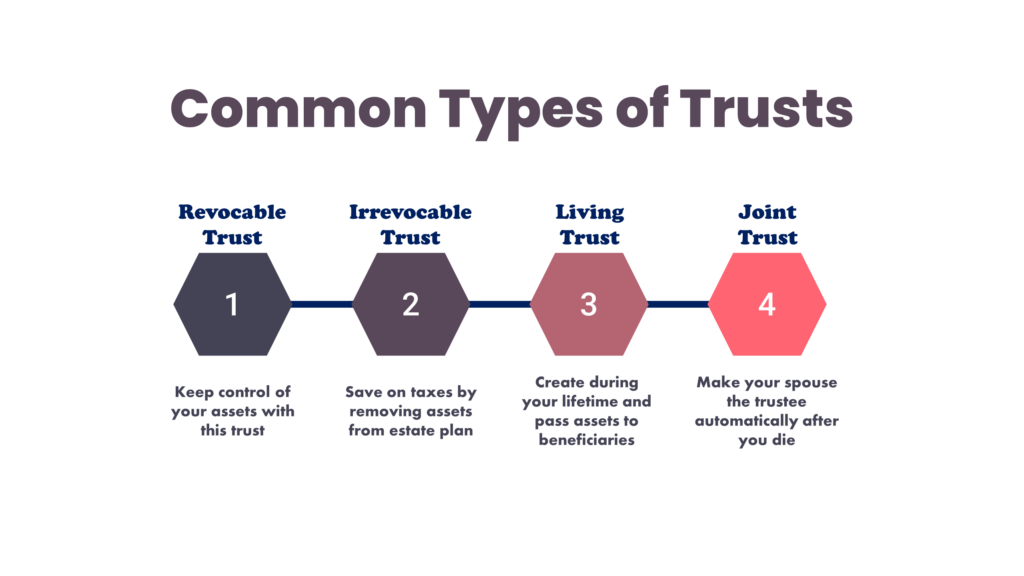

In addition, establishing a trust fund can provide a safe and secure method to protect your possessions for future generations. Trusts can assist you control exactly how your assets are distributed, decrease inheritance tax, and shield your riches from financial institutions. By executing these approaches and seeking expert suggestions, you can protect your properties effectively and protect your economic future.

Long-Term Asset Security

Long-lasting asset protection involves implementing measures to guard your properties from numerous dangers such as economic recessions, suits, or unexpected life events. One essential aspect of lasting property security is establishing a trust, which can supply substantial advantages in securing your properties from lenders and legal disagreements.

Additionally, diversifying your investment profile is one more essential strategy for lasting possession protection. By spreading your financial investments across various possession classes, sectors, and geographical regions, you can reduce the influence of market fluctuations on your total riches. Additionally, regularly assessing and updating your estate strategy is important to ensure that your properties are safeguarded according to your dreams over time. By taking an aggressive technique to long-term possession defense, you can secure your wide range and supply financial safety for yourself and future generations.

Conclusion

Finally, trust fund foundations play a vital duty in securing see this here assets and guaranteeing monetary protection. Expert assistance in developing and taking care of trust fund structures is important for long-lasting property defense. By making use of the knowledge of experts in this area, people can successfully guard their assets and prepare for the future with confidence. Count on foundations offer a solid framework for safeguarding riches and passing it on to future generations.

Report this page